1% of Startups become Unicorns !

What are the Odds Of Becoming A Unicorn? Apparently the answer is less than 1%.

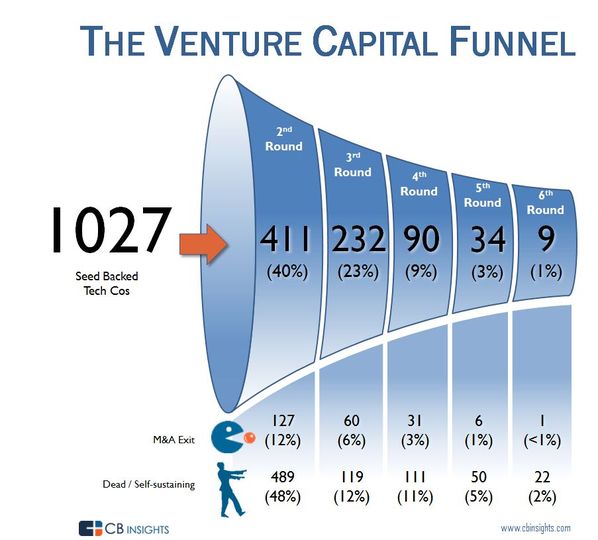

CB Insights analyzed over 1,000 startups.

They looked at those that raised seed rounds in 2009 – 2010.

They followed each startup’s journey until Q4 of 2015.

Here’s what they found:

![]() 40% raised a second round of funding.

40% raised a second round of funding.![]() The median Seed size disclosed was $500K.

The median Seed size disclosed was $500K.![]() 225 (22%) exited through M&A or IPO within 6 rounds of funding.

225 (22%) exited through M&A or IPO within 6 rounds of funding.![]() Only 9 companies (0.9%) reached a value of $1B+ (Instagram, Uber, and Slack).

Only 9 companies (0.9%) reached a value of $1B+ (Instagram, Uber, and Slack).

![]() 77% were either dead, the walking dead (bad outcomes), or became self-sustaining (a potentially good outcome for the company but probably not good for their investors).

77% were either dead, the walking dead (bad outcomes), or became self-sustaining (a potentially good outcome for the company but probably not good for their investors).

Trends:

It was easier to raise a second post-Seed financing than the first post-Seed financing. However, as startups moved into the middle and late stages, the proportion that managed to raise follow-on capital decreases. For the 3rd follow-on round after Seed the percentage dropped to 39%, and then to 38% for the 4th, and so on.

In the later follow-on rounds, the gap between the average amount raised and median amount raised becomes much higher, indicating the presence of mega-rounds.

![]() The lesson: Sometimes, the goal isn’t to become a unicorn – but to build a sustainable and profitable business that improves the lives of its customers.

The lesson: Sometimes, the goal isn’t to become a unicorn – but to build a sustainable and profitable business that improves the lives of its customers.

What do you think?

Founders and investors, how does the funnel below compare to your experiences?

Source: CB Insights

Author: Simona Alice Huebl (linkedin post)