Why wealth lasts 3 generations ?

I would gladly write about this subject as i have seen it manifest with my own eyes. Obviously, this is a simple generalization, that has many exceptions. But like any generalization it contain an element of truth.

There are some numbers found on the internet, i can not confirm if they are statistically accurate. Thus take them with a grain of salt. They state that 70% of wealthy families are no longer wealthy by the second generation. And approximately 90% have lost their wealth by the third generation.

If true, these numbers are alarming. There would be no long term multi-generational escape from the rat race.

There are a lot of popular sayings about the subject of loss of wealth by the 3rd generation.

The Chinese proverb “Rags to rags in three generations.” or “From peasants’ shoes to peasants’ shoes all in just three generations.” probably the oldest, says that family wealth does not last for three generations. The first generation is the one making the money, the second spends it and the third sees none of the wealth.

The adage: shirtsleeves to shirtsleeves in three generations, describes the three-generation rule for family businesses, says the third generation cannot manage the business and wealth they inherit, so the family company ultimately fails, and the wealth goes with its failure.

Before we address the reasons, let’s first clarify a point, this rule, apply to wealth generated from a family business. In other words, wealth generated by an entrepreneur. Wealth by investors is often way more robust, due to the simple reason of diversification. But in both cases, we are not talking about the billionaires.

Main reasons why wealth disappear within 3 generations:

1- Family Growth and inheritances taxation.

I think family growth is the biggest factor in splitting wealth, add to that the inheritance taxes that can reach up to 60% in countries like France.

Let’s make a small mathematical equation:

Wealth created at first generation $5 million split among 3 kids + wife = each gets let’s say 23% after “light taxation” or $1.15 million.

This 23% of the son (2nd generation) is split among 3 kids + wife = each has now around 6% of original wealth or $264 000.

Starting with $5 millions, we quickly reach 264000 in 3 generation. or the price of an apartment in a major city.

Starting with $50 millions, we can expect the 3rd generation to have less than $2 million each, due to higher taxes, 4th generation less than 500k.

let’s go higher, starting with $500 millions, we can expect the 3rd generation to have less than $10 million each, due to higher taxes, 4th generation less than $2.5 millions.

In all the above cases, we assume that each generation is able to generate enough money to maintain own lifestyle. And only the original inheritance is transmitted. And a big assumption, is the light taxation, even-though often it is not the case.

My great grandpa was very rich, owned multiple building in the center city of the capital. He had 5 kids, his kids each had a varying number of kids. One of the daughters had 9 kids, another 5, one of the boys had 3 and another (1). The inheritance was totally different for the branch with 1 end kid than the one with 9.

2- Family Drama.

Divorce, lawsuits, hate between siblings, eat up wealth like wild fire. Divorce is obviously a big money drain, but lawsuits between the family members can drag forever and cost a fortune. Hate between siblings means that whatever business the patriarch launched, it will not survive another generation. Father kids hate, means the business also will not survive another generation.

3- Entitlement.

If the kid has an entitlement problem, he will spend the money with no regrets. Thus, the following generation gets nothing. Living off the inheritance is easy, and can gobble whatever sum it is. Especially if the kid is a wannabe entrepreneur with no sense of business.

Add to this any drug, gambling problems, or even partying can become a money drain when you want to live a lavish lifestyle with no revenue to back it.

4- Lack of preparation of the next generation.

If the source of wealth is a family business, then, not preparing the next generation is a recipe for disaster.

You can not expect that the kid will be able to fill the founder shoes, if not properly prepared.

To be prepared, the kid should be knowledgeable in all the aspects of the company.

5- No clue about the value of money.

The person who created the wealth was often obsessive, but their kids were not hungry for success. Often the second and third generations — who have been raised wealthy, and thus much differently than the person who made the money to begin with — behave differently towards money.

When does the wealth last more than 3 generations ?

1- Money professional managed.

The family decide to have a professional CEO take care of the business. And or a professional family investment office to take care of investment. And each member of the family have a kind of allowance to live with.

2- Planned passing of the torch. and spendings

When each generation plan the passing of the torch to the next. Key members of the family are chosen and prepared to take care of business. Spending planned annually, keeping the essence and using the generated money.

3- Generational risks taking.

Taking risk is easy when you have a financial safety net, it is even more fun if the capital is a “loan” from parents. If each generation is taught to take risks without fearing bankruptcy or paying back the loans, the chance of wealth lasting and increasing will be higher.

let’s take the example of Donald Trump, he got a loan from his dad worth $1-60 million, and that helped him build a real estate empire.

In reality this option, is not only the original wealth, it is an aggregation of wealth, a multi-generational aggregation of wealth.

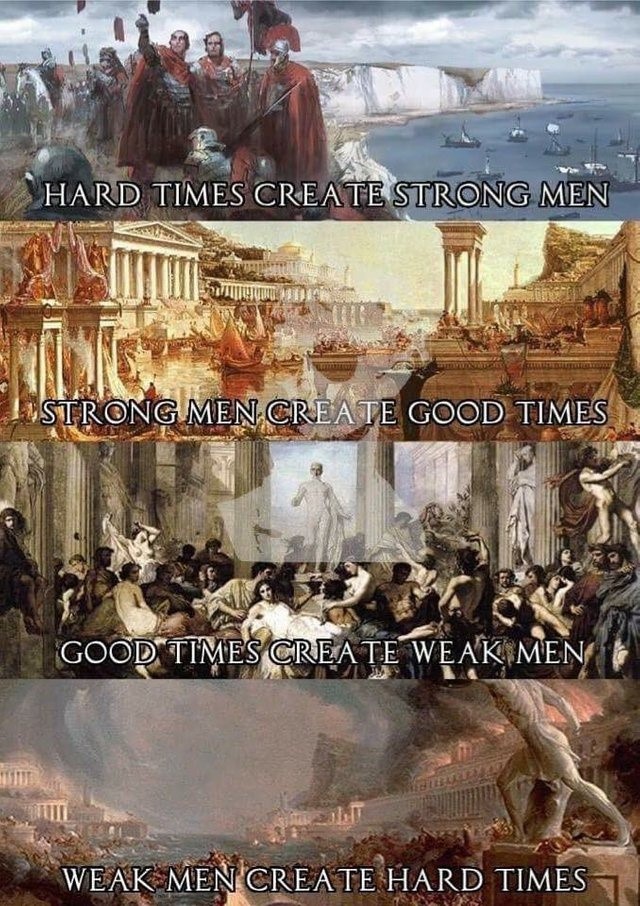

Simplification, why wealth do not last beyond 3 generations ?

The 1st generation hustles to get the family to the top, the original smart individual work hard and for long hours. The children witness how hard it is to climb the social pyramid, and often receive the essence of hard work or business smart with a live example.

The 2nd generation often continues increasing the family’s wealth. They usually let the money work for them, and usually do not overspend and continue to grow the family’s status. However, not having experienced it, but only taught, they fail to transmit with live example the essence of hard work and business smart.

The 3rd generation did not see how their family struggled, nor did receive a real essence of hard work and business smart. They possess a lot of capital and don’t know how to manage it. They overspend instead of saving or investing, and make poor financial decisions. When they run out of cash, they tend to continue the same habits, creating a massive “snowball” of credits. By the end, they sell all their assets for a reduced price to pay the bank loans.

Discuss this topic on the forum:

https://www.entrepreneurpost.com/forum/index.php?topic=22

Share or check some examples where wealth lasted more, and examples where wealth lasted 3 generations or less.